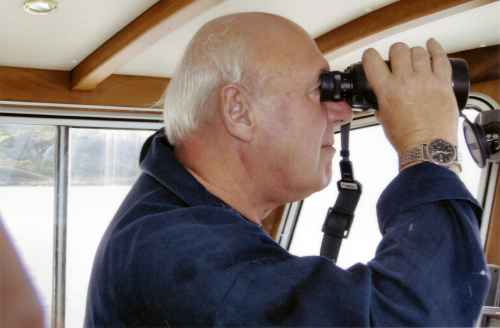

Author - Don Young

A voyage of discovery.....

www.havingtheircake.com is authored by Don Young. The website was originally created to supplement the material in a book, 'Having Their Cake', co-authored by Don and Pat Scott and published by Kogan Page*. A later book, “Enterprise Rules” by Don Young was published by Profile Books.**

Don Young says:

I started from the point of being very concerned about the behaviour of investors in companies that I worked for. Mostly, their understanding of the businesses seemed slight and their concerns much more about their stock portfolios than the success of the companies. Almost without exception, these companies suffered from a disease which did not infect the Japanese and German enterprises of which I became a director. This almost invariably fatal malaise was an addiction to big mergers and acquisitions. It started with Lex Service Group, which suffered from the twin disease of “Synergy” infection combined with “Big Acquisition” addiction. As a middle manager, I gathered black marks by questioning the sense of Lex’s behaviour. That company nearly collapsed before returning to their core business of motor vehicle distribution.

Thorn EMI was the next big disaster. By this time I was a senior manager, working for the chairman. Thorn EMI was a total shambles, being the result of a “merger” between Thorn Electrical Industries, a rather basic company involved in Domestic Appliance manufacture, mechanical engineering - and EMI, in music, entertainment and very high electronic technology. These two parent entities were themselves completely without any logic, being of course the result of financially driven strategies. Why on earth Thorn acquired EMI was beyond comprehension, apart from the likely fact that Sir Richard Cave, then chair of Thorn, wanted to do a “big one” before retirement and also nurtured a hatred for the chairman of EMI!

This story entered the realms of fantasy, when Peter Laister, who replaced Cave as chair of Thorn EMI, was found to be well on the way to making an even bigger “Move”, namely the merger with British Aerospace! Again, I was in serious trouble because I maintained that the first and only task was to sort out the Thorn and EMI mess and was vehemently opposed to any further big moves. This strategy resulted in Laister’s enforced departure after a cartoon appeared in the London Evening Standard portraying an aeroplane with washing machines hanging under its wings, with the caption “British Aerothorn”.

After becoming an executive director of Thorn EMI, working for Sir Colin Southgate, Laister’s successor, I left to co-found YSC a consultancy involved in corporate psychology, with Peter Samuel and (then) Charlotte Chambers, now my wife. This was in 1990, and YSC has to this day become one of the largest international consultancies of its kind.

This experience led me to becoming widely known as somebody who knew a thing or two about mergers and I was commissioned to support Redland plc in managing the biggest merger in its long history. To cut a long and very interesting story short, Redland, despite sterling work by its new chief executive, supported by a team of directors (including me), succumbed to a bid from Lafarge SA, mainly as the result of cash generation difficulties caused by a history of acquisitions.

The full Redland “story” can be found in the “Resources” section of this Site.

Concerns based on a rich and sometimes perilous career led to research for, writing with Pat Scott, and publication of "Having Their Cake"* analysing the changing relationships between the investment markets and the top managers of large quoted companies; and “Enterprise Rules”** which examines effective and dysfunctional management..

From there I embarked on an ever more fascinating journey, which broadly had the following stages:

- Investigating the motivations and activities of investment bankers and fund managers - and the trustees of larger pension funds

- Led by my interest in developing this website, broadening the scope of investigation into the dynamics of the banking and financial services industries and their impact on the wider populace

- This led to the growing conviction (about 2005) that the global investment banks had grown so powerful that they were beyond the influence of democratically elected governments - and in fact were influencing government behaviour by lobbying and "recruiting" politicians, especially in the USA and UK

- About this time, I became increasingly aware that some assumptions I was making about the benefits of free and unregulated markets were strongly influenced by what seemed to be streams of propaganda emanating from many institutes and foundations - and particularly most of the economic and financial media.

- It was then a short step to exploring the fascinating world of ideas and dogmas about free markets - what George Soros has called "Market Fundamentalism" - and realising that these were not "the truth", but rather untested axioms

- I became increasingly convinced that the system of global banking and financial services was causing more harm than good to industry, the economy and in particular to the bulk of people who comprise "Society"

- Then - the 2008 crash, when it seems that the whole edifice of market fundamentalism came crashing to earth. But did it? We are now witnessing a fascinating struggle between the immensely rich and powerful banking industry and the wider populations in many countries, which are angry but not quite clear how and where to focus their anger. In the middle are politicians, beset by pressures from people and the finance industries, which are spending £/$ hundreds of millions on lobbying. How this struggle will play out is fascinatingly uncertain, but the game is by no means over..........

In the course of this journey I have met many top managers, investors of all shapes and sizes, a few politicians, journalists and a goodly number of academics.

But in more recent years I have been deeply involved in Social Enterprise, working with Not-for-Profit organisations as a funder, coach and latterly co-founder. I have been inspired by the people I have met through such enterprises as the School for Social Entrepreneurs and more recently, Ipswich Community Media, founded some five years ago by a group of people local to that town. Ipswich Community Media CIC have recently established a partner Charity titled Ipswich Community Media and Learning CIO, of which I am currently chair, and which should provide a platform for extension into a wider range of activities over a much wider geographical area. Currently ICM support a massive range of activities aimed at individual and community development, using radio, recorded music, and face-to-face teaching and tuition.

And now, Climate Change! Spurred on by my colleagues, wife and particularly by my two sons, one a doctor in Australia, the other a senior manager with a global company who is based in Singapore, I have developed the Site to its current shape. Coronavirus has intervened, and my conviction is that those countries infected by Neo-liberal, Free Market dogmas will be less able to cope with both the pandemics and global warming, because their national governments have been seriously undermined.

The great thing is - the journey continues and the interest and passion to continue learning is unabated!

* “Having Their Cake, How the City and Top Managers are consuming British Industry”; Don Young and Pat Scott, Kogan Page, London, 2004.

** “Enterprise Rules”; Don Young, Profile Books, London, 2013